1xbet Azerbaycan Yükle Mobil Arizona Indir Android I

October 26, 2022Mostbet Uzbekistan Официальный Сайт Спортивных Ставок И Онлайн-казино Uz 202

October 27, 2022Content

- What are the Components of Reporting Cash Flow for Non-profits?

- Assets are things that an organization owns that have value.

- What Advantages Do Notes to Financial Statements for Nonprofits Serve?

- How Do You Read and Understand Nonprofit Financial Statements?

- Turn Your Nonprofit Website Into a Fundraising Tool: 5 Tips

- What are the Components of a Non-Profit Balance Sheet?

It must also show the change in net assets for both net assets without donor restrictions and net assets with donor restrictions along with a total change in net assets. Because net assets with donor restrictions are not available until released, the Statement of Activities will never show expenses of donor restricted amounts. Instead the amounts show as a release of restriction with the qualifying expenses showing as a change in net assets without donor restrictions. Expenses may be shown by nature or by function or both in the Statement of Activities. Expenses shown by nature present how the money was spent (salaries, rent, professional fees, etc.). Expenses shown by function present whether the money was spent towards program, administrative, or fundraising expenses.

- The method chosen should be the method that is most user friendly for those reading the financial statements.

- The nonprofit statement of activities is essentially a fund accounting report parallel to a for-profit’s income statement.

- Our non profit financial projection template provides up to 5 years of balance sheet, income statement and cash flow projections.

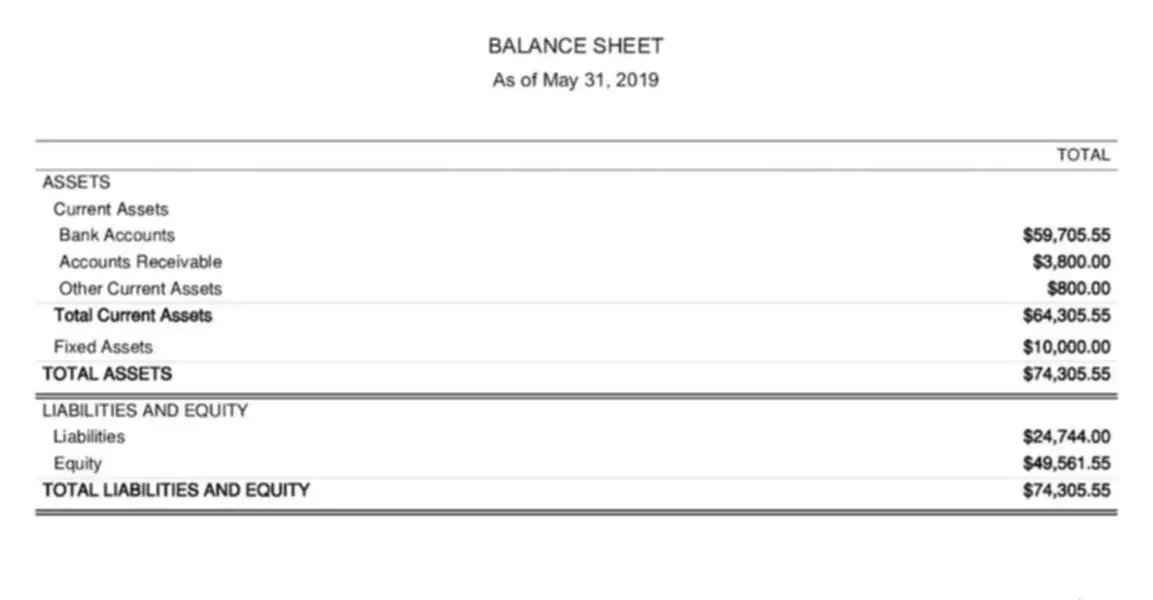

Similar to assets, liabilities are also classified as current or long-term based on the closeness to maturity. Net assets (equity) is the total amount of residual assets remaining in the nonprofit. Are you struggling to prepare your nonprofit financial statements accurately and transparently? Our team of experts specializes in providing non-profit accounting https://www.bookstime.com/ solutions and can help non-profit accountants ensure that their financial statements are prepared in accordance with accounting standards and best practices. One of the reasons nonprofits track expenses is to report on the percentage of its funds that go toward programs compared to funds spent on administration costs, such as employee salaries.

What are the Components of Reporting Cash Flow for Non-profits?

The third item on any balance sheet should show the difference between assets and liabilities—the total financial gain or loss. The net assets of a nonprofit balance sheet signify the departure from for-profit bookkeeping. Non-profit accounting software can be a valuable tool for managing and generating important financial statements for nonprofits. The balance sheet reports an organization’s assets (what is owned) and liabilities (what is owed). The net assets (also called equity, capital, retained earnings, or fund balance) represent the sum of all the annual surpluses or deficits that an organization has accumulated over its entire history. For those in a senior leadership role at a nonprofit, it’s important to acknowledge that these accounting statements tell a story.

Changes in net assets without donor restrictions shows whether an organization operated with a gain or a loss. At Smith and Howard, our nonprofit accounting professionals have extensive experience preparing financial statements https://www.bookstime.com/articles/financial-statements-for-nonprofits for nonprofit organizations, and can also provide support with audit, tax, and other accounting requirements. The financial statements of non-profit and for-profit organizations are prepared with a focus on specific attributes.

Assets are things that an organization owns that have value.

For example, a nonprofit is likely to have a separate general ledger account for each of its bank accounts. It may also have 50 general ledger accounts for each of its major programs, plus many accounts under its fundraising and management and general expense categories. Program expenses (or program services expenses) are the amounts directly incurred by the nonprofit in carrying out its programs. For instance, if a nonprofit has three main programs, then each of the three programs will be listed along with each program’s expenses.